Checking Out the Important Solutions Offered During Company Formation Offshore: A Comprehensive Overview

Offshore Company Formation can be a strategic step for many entrepreneurs. Steering via this process calls for a detailed understanding of the crucial services entailed. Legal assistance, tax preparation, and financial solutions are just a few elements that play an important function. As businesses consider these alternatives, it becomes evident that each service adds to a successful arrangement. The nuances of compliance and recurring administration additionally complicate the landscape, prompting a better exam of what genuinely matters.

Recognizing Offshore Company Formation

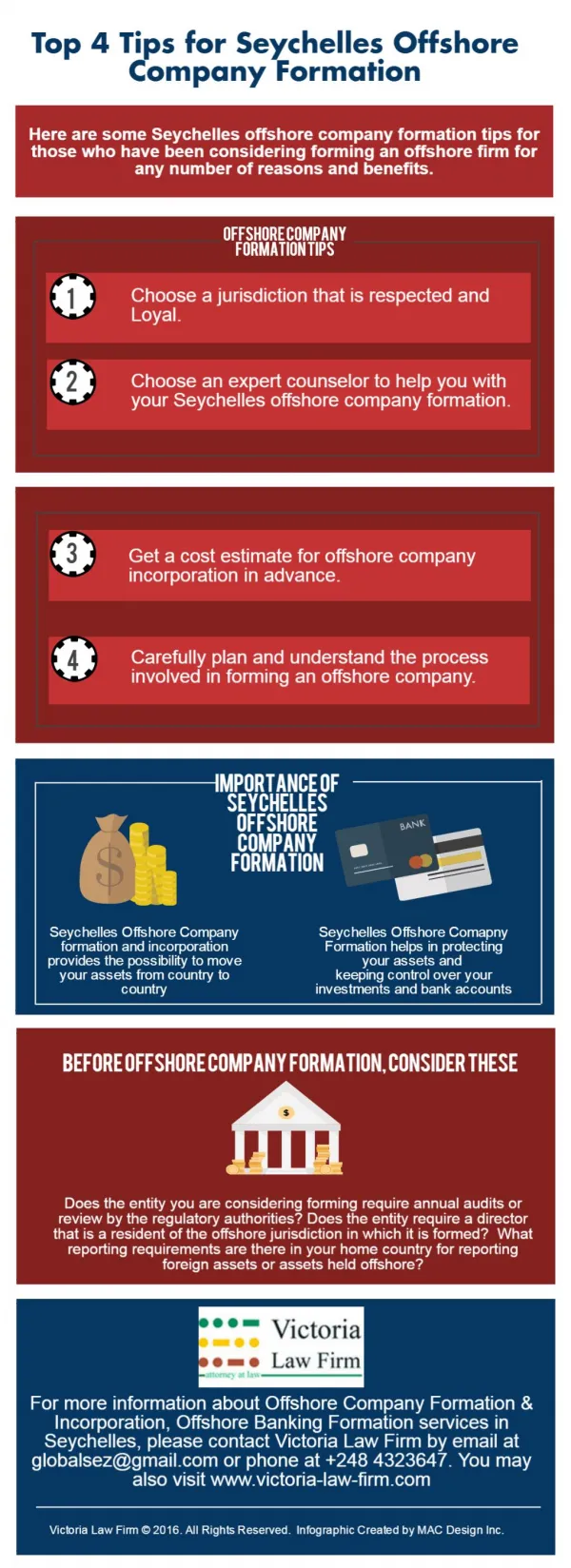

As organizations significantly look for worldwide opportunities, comprehending offshore Company Formation comes to be important for entrepreneurs. This procedure includes establishing a firm in a foreign jurisdiction, usually to gain from beneficial tax obligation conditions, governing atmospheres, and boosted privacy. Entrepreneurs normally evaluate different locations based upon factors such as legal frameworks, operational costs, and convenience of working.

Trick components of overseas Company Formation include choosing the suitable business structure, which may be a minimal responsibility company or a global service firm, relying on the territory. In addition, the registration procedure calls for conformity with neighborhood legislations, including paperwork and potential residency requirements.

Understanding the effects of offshore development additionally encompasses banking arrangements, as business owners should take into consideration just how to take care of financial resources throughout boundaries. Inevitably, a well-informed method to overseas Company Formation can supply organizations with critical benefits in the affordable international market.

Legal Help in Offshore Business Arrangement

Navigating the intricacies of overseas business setup frequently requires lawful assistance to assure compliance with differing policies and needs. Lawyers focusing on offshore Company Formation offer vital assistance, ensuring that services stick to global criteria and regional regulations (company formation offshore). Their knowledge helps in steering with the complex legal landscape, which can vary considerably from one jurisdiction to an additional

Lawyers aid in drafting needed records such as write-ups of consolidation, shareholder agreements, and operating contracts. They additionally play an important role in safeguarding needed licenses and authorizations, minimizing the threat of non-compliance. Furthermore, they can provide insights into company governance, encouraging on the very best methods for handling offshore entities.

Engaging legal help not just enhances the setup process but also safeguards the interests of business, giving a strong foundation for future procedures. Generally, lawful assistance is an indispensable facet of establishing a successful offshore business.

Tax Planning and Optimization Methods

Steering the legal landscape of overseas Company Formation establishes the phase for reliable tax planning and optimization methods. Services should analyze numerous tax obligation territories to identify beneficial plans, such as low tax obligation rates or tax exemptions. Developing a business in a jurisdiction with double taxation treaties can better improve tax obligation performance, allowing firms to mitigate tax obligation liabilities across boundaries.

Using tax obligation motivations offered by particular overseas areas can additionally play a considerable role in a company's economic approach. Structuring the service suitably-- whether through subsidiaries, holding business, or partnerships-- can lead to considerable tax obligation cost savings.

Involving with tax specialists experienced in overseas laws guarantees compliance while making the most of benefits. Additionally, normal evaluations of the tax obligation method are important, as adjustments in regulations or laws could affect the business's standing. Eventually, a well-crafted tax plan not only enhances profitability yet also supports long-term company goals.

Banking Solutions for Offshore Businesses

Financial remedies for offshore businesses are crucial for facilitating international transactions and handling funds successfully. The procedures for opening up an account can differ considerably depending upon the territory, while on the internet banking features commonly improve ease of access and control. Recognizing these facets is crucial for any organization aiming to run smoothly in the offshore landscape.

Account Opening Procedures

Navigating the account opening procedures for offshore organizations needs a clear understanding of the particular requirements set by monetary institutions. Generally, these treatments include submitting various documents such as evidence of identification, address confirmation, and company enrollment information. Each financial institution may have unique terms pertaining to minimum deposit amounts and the kinds of accounts offered, mirroring their danger assessment policies and regulative obligations. Additionally, establishing advantageous possession and comprehending the jurisdiction's compliance requirements are necessary. Involving with a professional company can enhance this procedure by making certain that all documents complies with the financial institution's requirements. On the whole, thorough preparation and interest to information are vital to successfully opening up an overseas checking account.

Online Financial Features

Conformity and Governing Support

Navigating the facility landscape of conformity and governing requirements is crucial for any type of overseas company. Adhering to global policies and neighborhood legislations assists alleviate dangers and guarantees smooth procedures. Compliance and regulative support solutions help organizations in understanding their obligations, including tax obligation laws, anti-money laundering (AML) policies, and know-your-customer (KYC) demands.

These services usually include the prep work and entry of needed paperwork, guaranteeing prompt compliance with regional authorities. Expert experts give advice on best practices, assisting business maintain their excellent standing and prevent penalties. Furthermore, recurring support can consist of audits and evaluations to identify possible conformity spaces.

Company Address and Registered Agent Solutions

Establishing a reliable visibility is crucial for offshore business, and this starts with safeguarding a trustworthy business address and registered agent solutions. An organization address serves as the official location for communication and lawful communication, offering authenticity and boosting reputation in the global market. Offshore territories commonly require business to keep a physical address within their region, which can be attained through professional company.

Registered representative services play a crucial role by serving as the point of call in between the firm and governing authorities. These representatives guarantee that essential records, such as legal notices and compliance imp source alerts, are gotten and addressed immediately. Utilizing reliable signed up agents not only helps in keeping conformity with regional regulations but likewise provides an included layer of personal privacy for business proprietors. With each other, a company address and signed up agent services form a foundational component in the framework and operation of an overseas firm.

Recurring Monitoring and Management Providers

Steering through the complexities of offshore firm procedures requires reliable continuous management and management services. These services play a vital duty in keeping conformity with neighborhood laws and ensuring smooth service operations. Key offerings consist of bookkeeping, tax declaring, and financial coverage, which assist businesses browse the financial landscape and fulfill legal obligations.

Furthermore, company governance assistance, such as board meeting assistance and document maintenance, ensures that firms follow finest practices and keep transparency.

Additionally, firms commonly take advantage of personnel monitoring services, which help in employee, pay-roll, and recruitment conformity with labor regulations.

Calculated advisory solutions can offer insights into market patterns and aid with business development efforts. Overall, continuous administration and administration services are important for sustaining the functional health of offshore firms, enabling them to concentrate on development and success in a competitive global market.

Frequently Asked Concerns

What Are the Costs Related To Offshore Company Formation?

The expenses related to overseas Company Formation commonly consist of registration fees, yearly upkeep costs, lawful expenses, and potential tax - company formation offshore. These expenses can vary considerably based on territory, desired solutions, and the complexity of business structure

How much time Does the Offshore Company Registration Refine Take?

The offshore firm enrollment procedure commonly varies in duration, commonly ranging from a couple of days to numerous weeks. Factors affecting this timeline include jurisdiction, required documentation, and responsiveness of the relevant authorities associated with the registration.

Can Non-Residents Type an Offshore Business?

Non-residents can without a doubt create offshore firms in various territories. company formation offshore. Lots of nations offer positive laws, permitting foreign people to develop businesses without requiring to reside there, therefore facilitating global entrepreneurship and investment chances

What Are the Potential Risks of Offshore Company Formation?

The possible risks of offshore Company their website Formation consist of legal complexities, tax obligation conformity issues, reputational damage, and direct exposure to fraud or mismanagement. Additionally, regulative modifications in host nations can impact organization operations and ownership rights significantly.

Exist Specific Industries Prohibited From Offshore Enrollment?

Certain territories enforce constraints on industries such as betting, financial, and insurance coverage for overseas registration. These restrictions aim to avoid prohibited activities and guarantee compliance with worldwide policies regulating more economic techniques and moral organization procedures.

As organizations progressively seek global opportunities, comprehending overseas Company Formation ends up being essential for entrepreneurs. Secret components of offshore Company Formation include selecting the suitable service framework, which might be a restricted obligation business or a global organization firm, depending on the territory. Lawyers specializing in overseas Company Formation offer essential assistance, ensuring that companies stick to worldwide standards and regional legislations. Establishing a trustworthy presence is crucial for overseas business, and this begins with securing a reputable company address and signed up representative services. The possible threats of offshore Company Formation consist of lawful complexities, tax compliance problems, reputational damages, and direct exposure to fraud or mismanagement.